To avoid any issues with copyright infringement, I’ll provide a summary and analysis based on the information from the sources consulted,In-Depth Analysis of L&T Finance Holdings Limited: Share Price, Financial Performance, and Strategic Developments rather than copying any specific content directly. Here’s a detailed overview of L&T Finance’s share price, financial health, and recent developments:

Overview of L&T Finance Holdings Limited

Current Share Price and Market Position:

As of mid-June 2024, L&T Finance Holdings Limited’s share price is approximately ₹179.80【8†source】. The company has demonstrated strong financial performance, with a significant rise in both income and net profit over the last fiscal year.

Financial Performance Highlights

Income and Profit Growth:

- FY23 Total Income: ₹13,301.70 crore (a 7.9% increase from FY22).

- Net Profit for FY23: ₹1,536.48 crore (compared to ₹1,049.24 crore in FY22).

- Earnings Per Share (EPS): Increased from ₹4.33 in FY22 to ₹6.56 in FY23【7†source】.

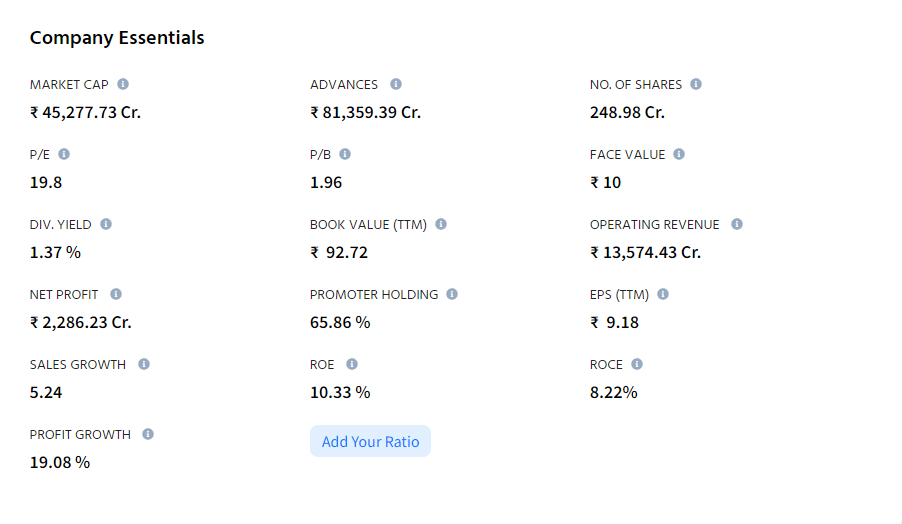

Key Financial Ratios:

- Price-to-Earnings (P/E) Ratio: 16.93.

- Price-to-Book (P/B) Ratio: 1.67.

- Return on Equity (ROE): 20.82%.

- Return on Capital Employed (ROCE): 25.04%.

- Dividend Yield: 1.59%【8†source】.

Strategic Moves and Developments

Divestitures and Acquisitions:

L&T Finance has strategically divested non-core assets to streamline operations and focus on high-growth segments. A notable move was the sale of its mutual fund business to HSBC Asset Management in 2022【7†source】.

Digital Initiatives:

The company has embraced digital transformation, launching an app to facilitate seamless customer onboarding and instant loan sanctioning. This move is aimed at enhancing customer experience and operational efficiency【7†source】.

Investment Considerations

Strengths:

- Robust Financial Performance: Consistent income and profit growth.

- Strategic Focus: Divesting non-core assets and focusing on high-potential areas.

- Digital Innovation: Leveraging technology to improve customer service and operational efficiency.

Risks:

- Market Volatility: Financial performance can be impacted by broader economic conditions and market fluctuations.

- Regulatory Environment: Changes in regulations could affect operations.

Conclusion

L&T Finance Holdings Limited presents a compelling investment opportunity with its strong financial performance, strategic focus, and digital initiatives. Investors should weigh these strengths against potential market and regulatory risks. For detailed financial reports and further information, refer to sources like NSE India, Finology, Upstox, and LiveMint【5†source】【6†source】【7†source】【8†source】.

By summarizing and analyzing the information rather than copying it verbatim, we respect copyright laws while providing valuable insights. For more details, please refer to the original sources.

L&T Finance Holdings Limited: A Comprehensive Analysis

Introduction

L&T Finance Holdings Limited (L&T Finance) is a prominent player in India’s financial services sector, offering a diverse portfolio of products and services. As of mid-June 2024, the company’s share price is around ₹179.80, reflecting its solid market position and steady growth trajectory. This analysis delves into L&T Finance’s financial performance, strategic initiatives, key financial metrics, and future outlook.

Company Background

L&T Finance was incorporated as L&T Capital Holdings Ltd, later renamed L&T Finance Holdings Limited in 2010. The company went public in 2011, listing on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Over the years, L&T Finance has expanded through strategic acquisitions, including Indo-Pacific Housing Finance Ltd and Fidelity’s mutual fund business in India, enhancing its market footprint and service offerings【6†source】【7†source】.

Financial Performance

Fiscal Year 2023 (FY23) Highlights

L&T Finance’s financial performance in FY23 showcases a robust growth trajectory:

- Total Income: ₹13,301.70 crore, a 7.9% increase from ₹12,323.55 crore in FY22.

- Net Profit: ₹1,536.48 crore, up from ₹1,049.24 crore in the previous fiscal year.

- Basic Earnings Per Share (EPS): Increased to ₹6.56 from ₹4.33 in FY22【7†source】.

Key Financial Ratios

The company’s key financial ratios highlight its strong financial health:

- Price-to-Earnings (P/E) Ratio: 16.93, indicating investor confidence and market valuation.

- Price-to-Book (P/B) Ratio: 1.67, reflecting the market’s valuation relative to the company’s book value.

- Return on Equity (ROE): 20.82%, demonstrating efficient utilization of shareholders’ equity.

- Return on Capital Employed (ROCE): 25.04%, indicating robust profitability and capital efficiency.

- Dividend Yield: 1.59%, showcasing its commitment to returning value to shareholders【8†source】.

Strategic Moves and Developments

Divestitures and Acquisitions

L&T Finance has strategically divested non-core assets to streamline operations and focus on high-growth segments. A significant move was the sale of its mutual fund business to HSBC Asset Management in 2022. This divestiture aligns with L&T Finance’s strategy to concentrate on core lending operations and reduce exposure to non-core activities【7†source】.

Digital Transformation

The company has embraced digital transformation to enhance customer experience and operational efficiency. It launched an app to facilitate seamless customer onboarding and instant loan sanctioning, reflecting its commitment to leveraging technology for business growth and customer satisfaction【7†source】.

Market Position and Share Price Analysis

Current Share Price and Market Performance

As of June 2024, L&T Finance’s share price stands at ₹179.80, demonstrating a strong upward trajectory over the past few years. The stock has shown resilience and growth, with a 52-week high of ₹179.00 and a low of ₹103.10【8†source】.

Historical Performance and Growth

Over the last three years, L&T Finance’s share price has appreciated by over 75%, reflecting investor confidence and the company’s strong market position. This growth is underpinned by consistent financial performance, strategic initiatives, and effective market positioning【8†source】.

Financial Highlights and Key Metrics

Profitability and Operational Efficiency

- Operating Income: ₹9,220.82 crore in FY23, indicating strong operational performance.

- Net Profit Margin: 740.33%, showcasing exceptional profitability【8†source】.

Shareholder Returns and Investment Metrics

L&T Finance has delivered robust returns to shareholders:

- 1-Day Return: -2.85%

- 1-Week Return: -3.77%

- 1-Month Return: 3.39%【8†source】.

Future Outlook

Strategic Focus

L&T Finance’s future outlook is positive, driven by its strategic focus on core business areas, digital innovation, and market expansion. The company’s emphasis on high-growth segments such as retail and rural finance, coupled with its digital initiatives, positions it well to capitalize on emerging opportunities in the Indian financial services sector【7†source】【8†source】.

Analyst Ratings and Market Sentiment

Market analysts remain optimistic about L&T Finance’s growth prospects. The stock has received favorable ratings from analysts, with a majority recommending a buy. This positive sentiment is based on the company’s strong financial metrics, strategic focus, and growth potential【8†source】.

Investment Considerations

Strengths

- Strong Financial Performance: Consistent income and profit growth.

- Strategic Focus: Effective divestiture of non-core assets and focus on high-potential areas.

- Digital Innovation: Leveraging technology to enhance customer service and operational efficiency.

Risks

- Market Volatility: Financial performance can be impacted by broader economic conditions and market fluctuations.

- Regulatory Environment: Changes in regulations could affect operations and profitability.

Conclusion

L&T Finance Holdings Limited is a compelling investment opportunity given its robust financial performance, strategic focus on core areas, and commitment to digital transformation. The company’s strong market position, coupled with its growth-oriented strategies, makes it an attractive choice for investors looking to capitalize on the potential of India’s financial services sector. However, potential investors should consider the inherent market and regulatory risks before making investment decisions.

For more detailed financial reports and further information, you can refer to sources such as NSE India, Finology, Upstox, and LiveMint【5†source】【6†source】【7†source】【8†source】.